Boohoo more valuable than M&S – a sea-change encapsulated

From a purely journalistic standpoint it is now a de facto cliché to refer to Marks and Spencer as the “high street bellwether”, yet that is the status it has held for so many decades.

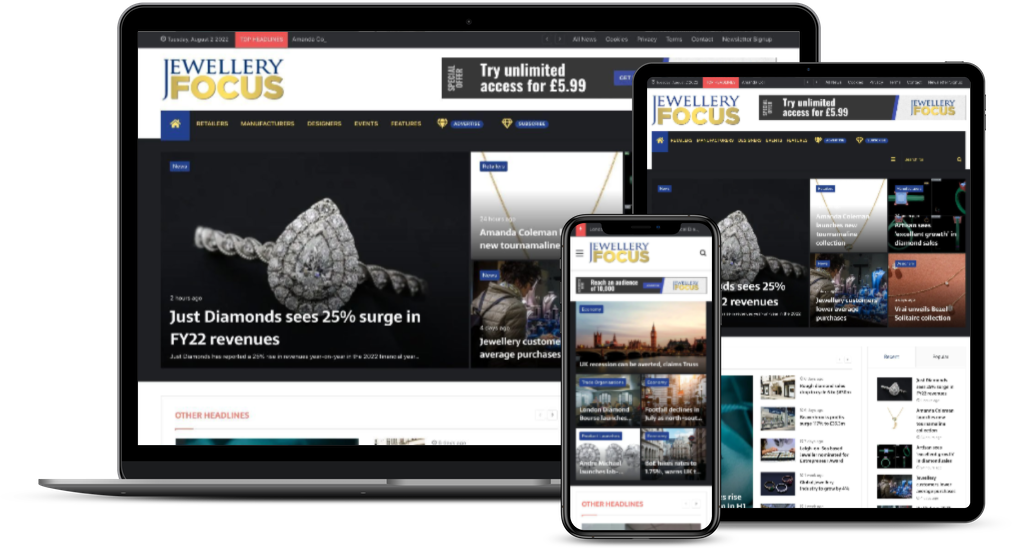

Join 5,000 jewellery professionals with a membership

Get unlimited access and stay in the know. First-year special offer pricing. Cancel any time.

You'll need to subscribe to continue.

How many members should have access to the subscription?

Monthly

Yearly

Save £9.89

No, thanks

I already have an account

From a purely journalistic standpoint it is now a de facto cliché to refer to Marks and Spencer as the “high street bellwether”, yet that is the status it has held for so many decades.